Car title loans Cameron TX provide fast cash secured by vehicle equity, with competitive rates and flexible terms. Simplified eligibility criteria make them an accessible alternative to traditional bank loans. Reputable lenders, as evidenced by customer reviews, ensure ethical practices. Beyond interest rates, consider total costs, hidden fees, repayment flexibility, and Fast Cash options for immediate funds without compromising vehicle ownership.

When considering car title loans Cameron TX, it’s crucial to make an informed decision. This guide helps you navigate the process by first understanding car title loans as a short-term financing option secured by your vehicle. Next, we delve into evaluating lender reputaties and reviews to ensure trustworthiness. Finally, comparing loan terms and rates allows you to choose the best deal for your situation.

- Understanding Car Title Loans Cameron TX

- Evaluating Lender Reputations and Reviews

- Comparing Loan Terms and Rates

Understanding Car Title Loans Cameron TX

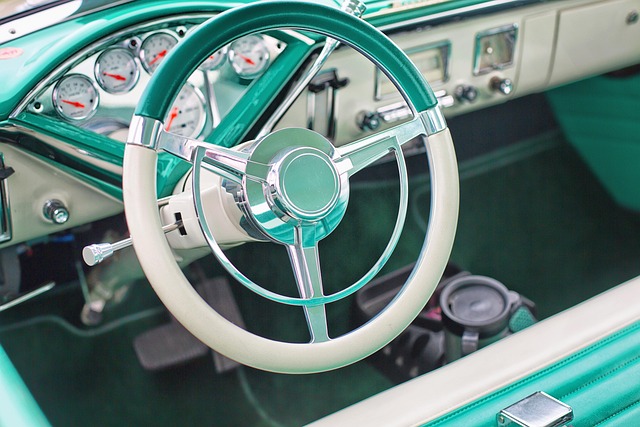

Car title loans Cameron TX are a type of secured loan where borrowers use their vehicle’s equity as collateral. This option is available for those who own their vehicles outright and are looking for quick cash. The process involves using your car’s registration and title as security, allowing lenders to offer competitive interest rates and flexible repayment terms. Unlike traditional bank loans, these loans have simpler eligibility criteria, making them accessible to a broader range of borrowers.

In the fast-paced world where immediate financial support is often needed, understanding the Car title loans Cameron TX process can be advantageous. It provides an alternative solution to San Antonio Loans, especially for individuals with good vehicle equity. The Title Loan Process typically entails providing proof of ownership, vehicle inspection, and signing a loan agreement. Once approved, borrowers can gain access to funds quickly, making it a convenient option when urgent financial needs arise.

Evaluating Lender Reputations and Reviews

When evaluating potential lenders for a car title loan in Cameron TX, it’s crucial to look beyond just interest rates and terms. Reputations and reviews play a significant role in ensuring a positive experience. Start by checking online platforms where borrowers share their experiences with various lenders. Look for consistent patterns of satisfaction or complaints about specific institutions. A reputable lender like Houston Title Loans understands the importance of transparency and fair practices, as evidenced by their straightforward title loan process.

Reading reviews from San Antonio Loans customers can provide insights into the level of service, professionalism, and customer support offered. Positive feedback indicates a commitment to ethical lending while negative reviews might highlight red flags, such as aggressive collection tactics or hidden fees. By thoroughly evaluating these aspects, borrowers in Cameron TX can make informed decisions when choosing a lender for their car title loan needs.

Comparing Loan Terms and Rates

When comparing loan terms and rates for Car Title Loans Cameron TX, it’s crucial to look beyond just the interest rate. Consider the overall cost of the loan over its lifespan, including any fees charged. Some lenders offer attractive low-interest rates but include hidden costs that can significantly increase your expenses. Always read the fine print carefully.

Additionally, assess the flexibility of repayment terms. Different lenders may have varying options for repayment schedules and prepayment penalties. If you opt for a Fast Cash solution with a reputable lender, you might enjoy the convenience of keeping your vehicle while accessing immediate funds, even if you’re considering Semi Truck Loans. This can be particularly beneficial in unexpected financial situations where you need quick access to capital without sacrificing your primary mode of transportation.

When considering car title loans Cameron TX, it’s crucial to balance convenience with reliability. By understanding loan terms, evaluating lender reputions through reviews, and comparing rates, you can make an informed decision that aligns with your financial needs. Remember, a reputable lender specializing in car title loans Cameron TX can provide the funds you require quickly and efficiently, helping you navigate unexpected expenses with ease.